Restricted Authorization Network

Control your custom card programs

Through our Restricted Authorization Network (RAN), credit and prepaid card issuers gain the capability to manage acceptance and craft personalized encounters that seamlessly boost sales and revenue.

Our Restricted Authorization Network (RAN) empowers credit and prepaid card issuers to control acceptance and create tailored experiences that drive sales and revenue seamlessly.

What is RAN?

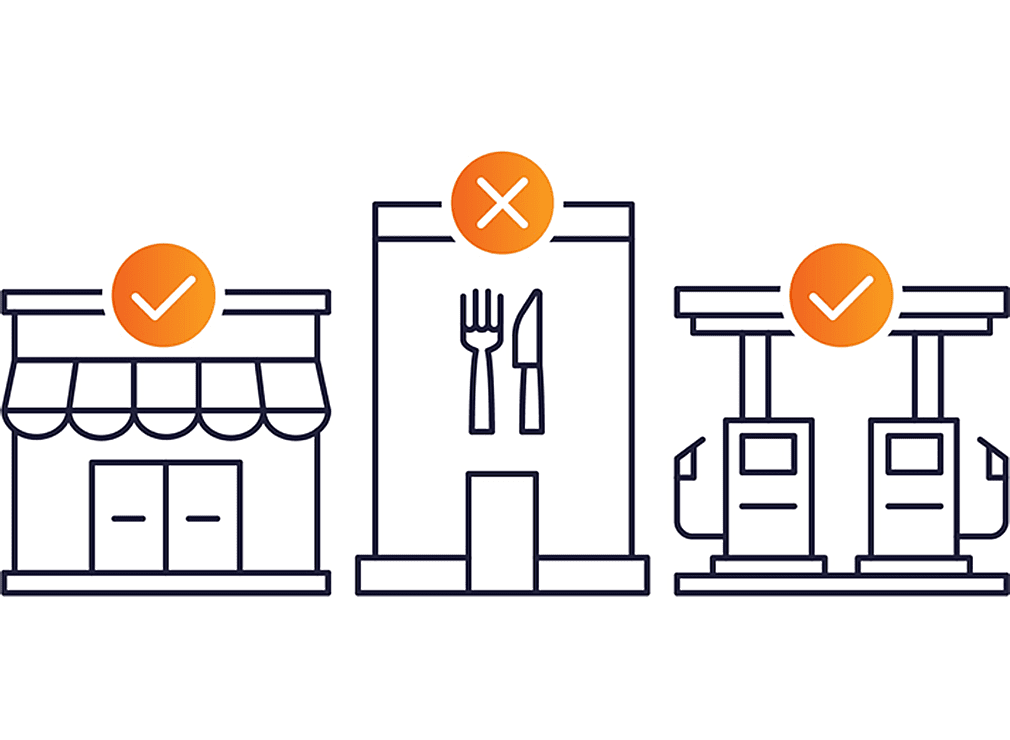

Utilizing a Restricted Authorization Network permits you to personalize the manner and locations where cards are viable, resulting in distinct cardholder benefits. RAN facilitates precise targeting of payment card utilization, delivering a blend of control, adaptability, and precision.

Control

Restrict purchases based on a specific business, category, brand or location.

Flexibility

Add and delete businesses and other attributes as needed.

Accuracy

RAN data is continually monitored and updated to increase accuracy.

Create and manage your program with ease

Unique card programs are easier to set up and manage on a RAN.

You can get your RAN program started in three steps:

- You establish the criteria for your RAN to determine acceptance

- RAN identifies the businesses to include based on your criteria

- Activate the program and authorize transactions based on attributes

Get started with RAN

Get more information

Discover further insights into the functionalities of our Restricted Authorization Network and how it can assist you in crafting personalized payment encounters.

Our experts are ready to collaborate

We’re here to power your innovation and work together to improve your business.